s the future of Las Vegas casinos at risk? Derek Stevens, a prominent casino owner in Downtown Las Vegas, has voiced his concerns over the gambling tax provisions included in President Donald Trump’s controversial “One Big Beautiful Bill.” According to Stevens, these provisions could have devastating consequences for the gaming industry, tourism, and employment in Las Vegas, one of the world’s most famous gambling destinations.

Also Read: Michael Mizrachi Wins 2025 WSOP Main Event, Hall of Fame Induction Caps Legendary Run

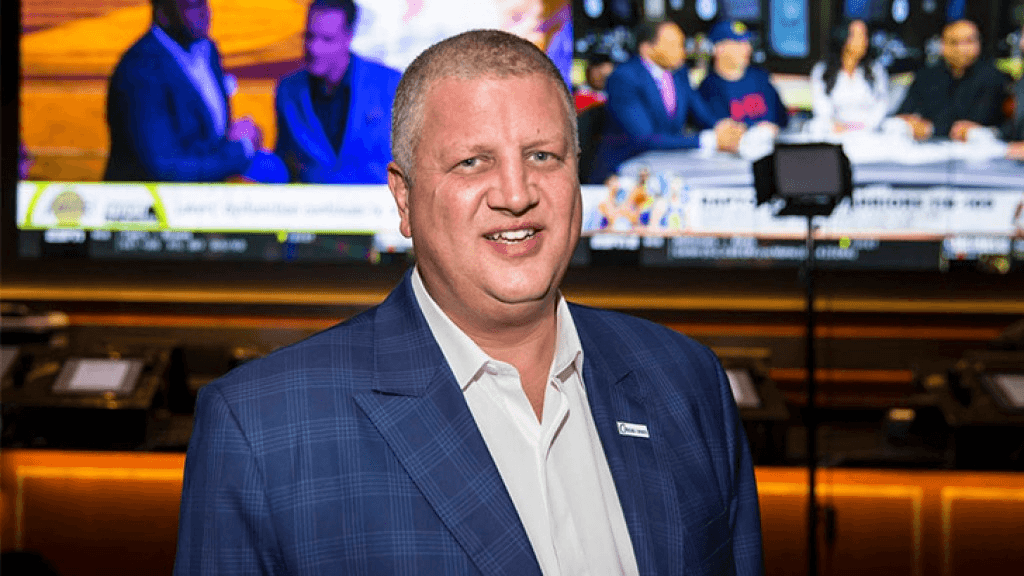

Derek Stevens’ Stance on the Gambling Tax Provisions

Derek Stevens, the owner of several notable casinos in Downtown Las Vegas—including The D, Golden Gate, and Circa Casino—has expressed strong opposition to the gambling tax provisions in the bill. The new tax rule under the “One Big Beautiful Bill” would limit gamblers to deducting only 90% of their losses, a sharp contrast to the previous system, where losses could be fully deducted. Stevens argues that this provision could severely undermine the gambling industry, pushing players toward offshore online casinos and depriving states of valuable tax revenue.

In a recent statement, Stevens highlighted that the move could ultimately harm both the gaming industry and the livelihoods of those employed in Las Vegas’ iconic casino sector. “This affects everyone in Las Vegas,” Stevens told KTNV. “This impacts jobs. It impacts visitation, tourism. It’s an important thing that just needs to be corrected.” He believes the provision, pushed through by legislators, was rushed and not fully understood by lawmakers, which could spell trouble for the future of Sin City.

The Impact on Employment and Tourism

Las Vegas thrives on its robust tourism sector, with millions of visitors coming annually to try their luck at the casinos, enjoy live entertainment, and partake in world-class dining and nightlife. Stevens warned that any disruption to this delicate ecosystem could have far-reaching effects. The gambling tax changes could lead to fewer people gambling, less money being won, and a drop in tourism overall.

For a city that relies so heavily on tourism and gaming revenue, this provision could have a domino effect. Fewer visitors would not only harm casino operators but also affect hotels, restaurants, entertainment venues, and retail businesses that are part of the Las Vegas experience. As Stevens pointed out, fewer people will visit Las Vegas, resulting in the loss of local jobs in the hospitality and entertainment industries.

Also Read: Michael Mizrachi Eyes History at the 2025 WSOP Main Event

A Growing Concern Among Poker Players

Stevens isn’t the only one raising alarms about the new gambling tax provision. Many professional poker players have taken to social media to voice their concerns. Doug Polk, a well-known poker pro, made a video explaining the potential damage to the poker industry, emphasizing that the new provisions could drive players toward illegal and offshore gambling operations.

Polk explained, “There will be fewer people that can gamble, less money to be won, more people going overseas, more people going (through) illegal routes.”

The ripple effects of these changes could be felt across the entire gaming community, from recreational gamblers to professional poker players. Polk’s concerns echo Stevens’ worries, painting a grim picture of the future if the provisions remain unchanged.

The Fight for a Fix: Stevens’ Hopeful Outlook

Despite his concerns, Stevens remains optimistic that the situation can be remedied. Representative Dina Titus from Nevada introduced the FAIR BET Act (Fair Accounting for Income Realized from Betting Earnings Taxation Act), which seeks to nullify the new gambling tax provision and restore the full 100% loss deduction. However, the proposed bill has faced opposition, particularly from Republican Senator Todd Young, complicating the path to a solution.

Stevens, who has already met with lawmakers to discuss the issue, is hopeful that a simple fix is still possible. He believes that reversing the provision will benefit everyone involved, from state governments to gamblers, both recreational and professional. “It should be a very simple fix, but I know everything gets a little more complicated sometimes than it ought to be,” Stevens said.

For now, Stevens and others in the casino and poker communities are hoping that lawmakers will recognize the broader impact of the tax changes and work toward restoring the previous system, ensuring that Las Vegas remains a hub for gaming and entertainment.

Conclusion: A Critical Moment for Las Vegas and the Gambling Industry

As Las Vegas casino owners and poker professionals rally against the new gambling tax provisions, one thing is clear: the future of the industry hangs in the balance. While the tax provision was likely not intended to harm Las Vegas, its consequences could be devastating for the city’s economy, tourism, and employment. The poker and gaming communities must continue to advocate for a fairer system that supports both state revenues and the livelihoods of those who depend on the gambling industry.

FAQs

- What is the gambling tax provision in Trump’s “One Big Beautiful Bill”?

The provision limits gamblers to deducting only 90% of their losses, a change from the previous rule where losses could be fully deducted.

- How could this provision impact Las Vegas?

The tax changes could lead to fewer gamblers, lower tourism, and job losses in the casino and hospitality sectors, affecting the city’s economy.

- Is there a potential solution to the gambling tax provision?

Yes, Representative Dina Titus has introduced the FAIR BET Act, which aims to restore the full loss deduction, though it faces opposition in the Senate.

Stay informed about the latest developments in the gambling world. Follow Better Poker News for up-to-date coverage on all major changes, events, and industry insights!

1 Comment

Pingback: WPT’s Texas Debut: A New Era for Lone Star Poker